These technologies drive returns through cost savings and increased efficiency

Our industrial transition investment thesis is built around two key trends:

Accelerating deep tech innovation

We are witnessing an accelerating digitalisation of industry coupled with sustained innovation in a diverse set of sciences and related engineering disciplines. From this, entrepreneurs are developing breakthrough technologies and applications that can bring strong competitive benefits to industrial customers – but requiring catalytic capital and networks to scale.

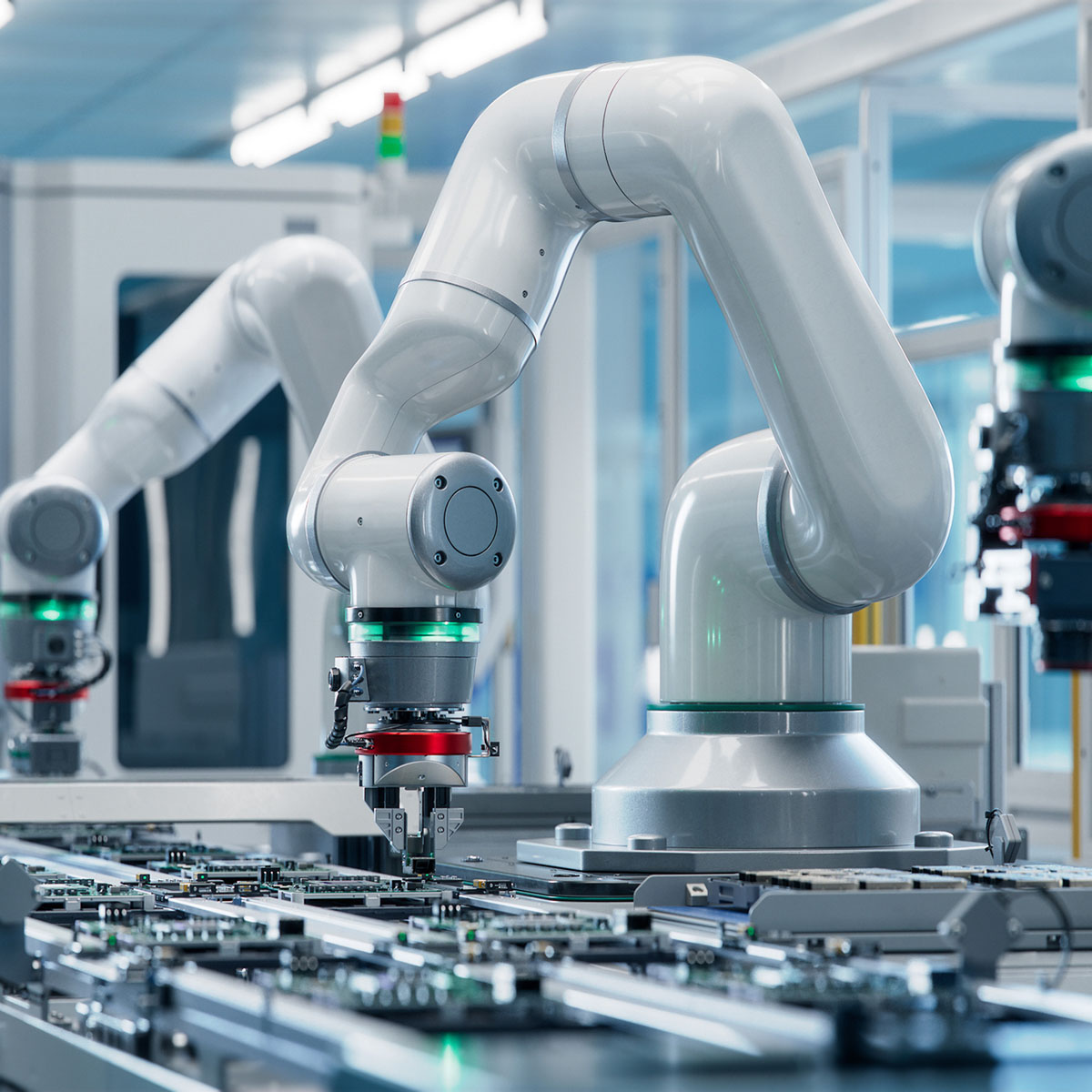

Historic underinvestment in hardware

Hardware has been less well funded by venture capital historically, due to factors such as capital intensity, incremental innovation, long sales cycles and the need for unique skills and networks. However, with significant macro trends now supporting the adoption of these technologies we believe that there is a unique opportunity to drive significant returns whilst making a positive impact on our environment. Our investments often combine innovative hardware and software elements.

Our investment style & impact

Active investment style, leveraging our experience and networks

We have an active investment style, looking to support our investee companies through input at Board level and by leveraging our networks. Our team can draw on decades of experience in finance, industry and science.

Our approach and impact

We take a holistic approach to assessing and measuring the impact of our portfolio companies. We regard the Stockholm Resilience Centre’s Planetary Boundaries framework as a very useful tool to do so. We invest in companies that have a positive impact on at least one planetary boundary, whilst not significantly adversely impacting any other boundaries.